In each case a positive variance is unfavorable and means that the current schedule is greater than the baseline value. Favourable variance is that variance which is good for business while unfavourable variance is bad for business.

Direct Materials Variance Analysis Accounting For Managers

Less revenue is generated or more costs incurred.

. An unfavorable budget variance describes negative variance indicating losses or shortfalls. Less revenue is generated or more costs incurred. An unfavorable variance has a result of decreasing the account balance relative to the budgeted amount.

Lower revenues and higher expenses are referred to as unfavorable variances. In the field of accounting variance simply refers to the difference between budgeted and actual figures. Basically whenever you predict something youre bound to have either a favorable or unfavorable variance.

Lower revenues and higher expenses are referred to as unfavorable variances. Rising costs for direct materials or. Budget variance is the difference between expenses and revenue in your financial budget and the actual costs.

When revenue is higher than the budget or the actual expenses are less than the budget this is considered a favorable variance. Less revenue is generated or more costs incurred. Unfavorable variances mean your prediction is better than the actual outcome.

The reporting of favorable and unfavorable variances is a key component of a command and control system where the budget is the standard upon which performance is judged and variances from that budget are either. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. If actual expenses are higher than the budgeted amount the difference between the two amounts is an unfavorable variance because we spent over budget which reduces our profits.

During the budgeting process a company does its best to estimate the sales revenues and expenses it will incur during the upcoming accounting period. Variance analysis is a known quantitative technique that involves identification and evaluation of causes behind differences between actual costsrevenues and standard or expected revenuescosts. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected.

Favorable variances mean youre doing better in an area of your business than anticipated. Budget variances occur because forecasters are unable to predict future. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected.

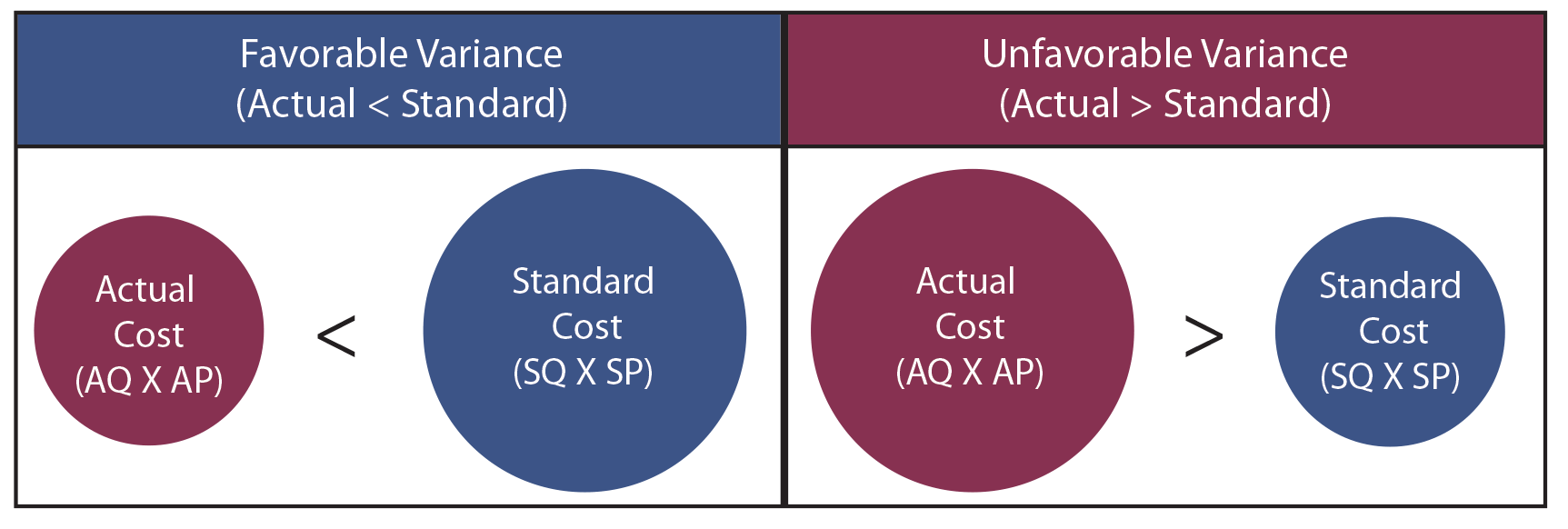

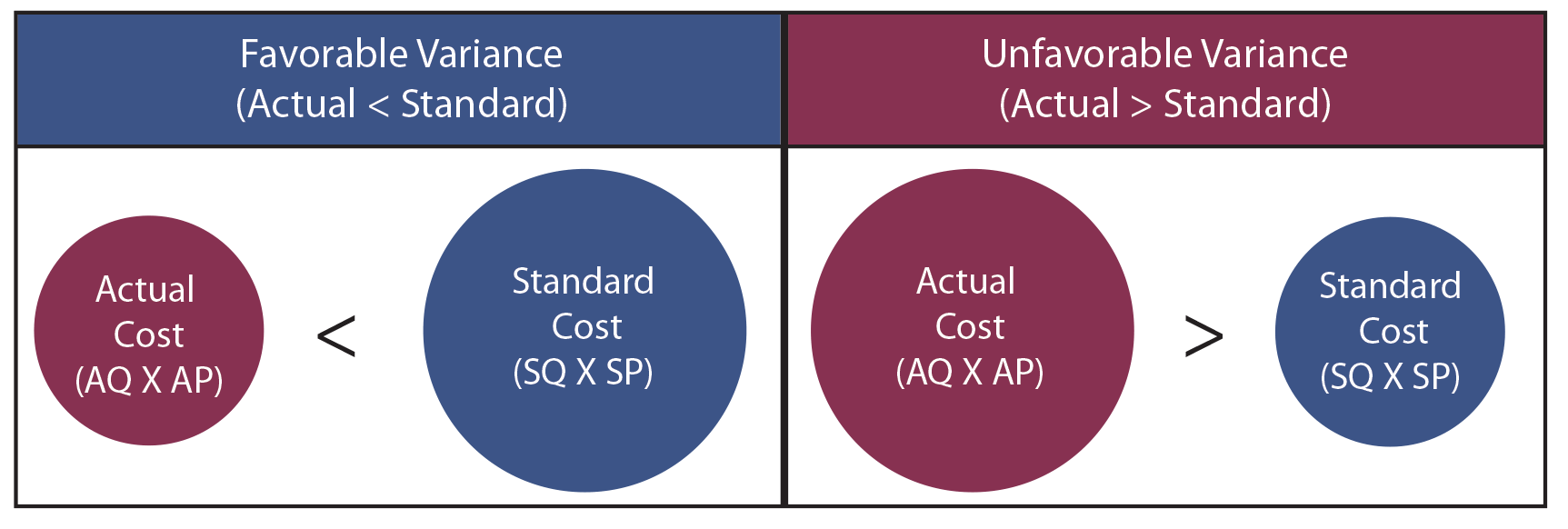

An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs. Either may be good or bad as these variances are. However if actual expenses are lower than the budgeted amount the difference is a favorable variance because we were able to spend less than we thought we would have to.

You can have variances in your. Unfavorable variances refer to instances when costs are higher than your budget estimated they would be. Unfavorable variances are the opposite.

A favorable unfavorable fixed overhead volume variance indicates that total fixed overhead cost allocated to units manufactured was greater less than the total budgeted fixed overhead cost. In the field of accounting variance simply refers to the difference between budgeted and actual figures. Higher revenues and lower expenses are referred to as favorable variances.

Either may be good or bad as these variances are based on a budgeted amount. Unfavorable variances are the opposite. Unfavorable variances are the opposite.

A favorable budget variance refers to positive variances or gains. Variances are analysed in terms of being favourable or unfavourable for business and are monetized as a difference given a financial value it is more easier for the relevant. On the other hand if tasks are completed earlier than scheduled or with less effort or less money the corresponding variance would be a negative number and would be regarded as favorable.

If revenues were higher than expected or expenses were lower the variance is favorable. After the period is over management will compare budgeted figures with actual ones and determine variances. An unfavorable budget variance describes negative variance indicating losses or shortfalls.

What is a favorable variance and what is an unfavorable variance. A favorable unfavorable fixed overhead volume variance indicates that total fixed overhead cost was overallocated underallocated to units manufactured. A favorable variance has a result of increasing the account balance regardless of the account type relative to the budgeted amount.

Budget variances occur because. Either may be good or bad as these variances are based on a budgeted amount. A favorable budget variance refers to positive variances or gains.

Click to see full answer. When revenue is involved a favorable variance is when the actual revenue recognized is greater than the standard or budgeted amount. Higher revenues and lower expenses are referred to as favorable variances.

What difference between a favorable variance and an unfavorable variance.

Variance Analysis Principlesofaccounting Com

Determining Which Cost Variances To Investigate Accounting For Managers

0 Comments